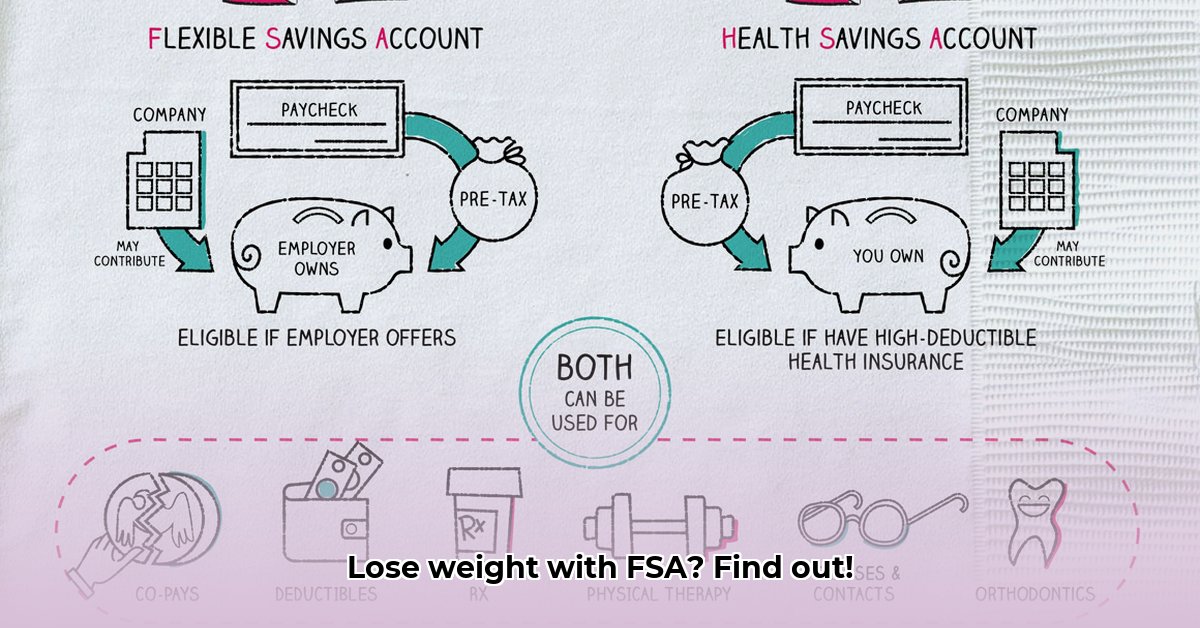

Can You Use Your FSA for Weight Loss? The Importance of Medical Necessity

Using your Flexible Spending Account (FSA) for weight loss programs isn't a simple yes or no. It hinges on whether your weight loss is deemed medically necessary to treat an underlying health condition. Your FSA isn't for general wellness; it's for medical expenses. Think of it like this: your insurance covers a broken arm – weight loss might be covered if it's addressing a health problem linked to your weight, such as diabetes or sleep apnea. This requires your doctor's assessment.

The Doctor's Note: Your Key to FSA Coverage

To use your FSA, you'll almost certainly need a Letter of Medical Necessity (LMN) from your physician. This letter states that a weight loss program is medically necessary to address a specific health condition linked to your weight. This isn't a simple conversation; it involves a detailed discussion of your health history and how weight loss addresses diagnosed issues. The more detail your doctor provides linking your weight to a specific health problem, the stronger your case.

What Your Doctor Needs to Know

Before your appointment, gather information about your weight, relevant health conditions, and your weight loss goals. Be prepared to discuss your medical history thoroughly. The clearer the link between your weight and a diagnosed condition, the better the chances of securing an LMN.

Types of Weight Loss Programs and FSA Eligibility

The types of programs covered varies by FSA provider, but some general principles apply.

Programs with Higher Chances of Approval

Structured programs with medical supervision generally fare better. This usually includes regular check-ins with a doctor or dietitian, incorporating elements like behavior modification, nutritional counseling, and exercise plans. The key is medical oversight.

Programs with Lower Chances of Approval

Generic weight loss programs—those focused solely on aesthetics or general wellness—are less likely to be covered. The emphasis remains on medical necessity. Online programs, while convenient, might face more scrutiny.

Weighing Your Options: A Risk Assessment Matrix

| Program Type | FSA Eligibility Risk | Effectiveness Risk | Improvement Strategies |

|---|---|---|---|

| Commercially-driven online weight loss plans | High | Variable | Secure pre-approval; choose programs with medical supervision and proven results. |

| Clinically supervised in-person program | Low | Moderate | Ensure detailed progress reports and alignment with doctor's recommendations. |

| Programs involving medication or surgery | Moderate | Moderate to High | Obtain pre-approval and detailed medical necessity documentation. |

Remember, your FSA provider’s specific rules might be even stricter than general guidelines. Always check your plan documents.

A Step-by-Step Guide to FSA Reimbursement for Weight Loss

Ready to navigate this process? Follow these steps:

Consult Your Doctor: Discuss your weight, health concerns, and interest in a weight loss program. An LMN is essential. (This is the most crucial step).

Research Programs: Once you have your doctor's approval (LMN), research programs that align with your needs and your FSA plan.

Review Your FSA Plan: Carefully read your FSA plan's rules and regulations to understand covered expenses and limitations.

Submit Claims Properly: Follow your FSA provider's claim submission instructions precisely. Keep copies of all documents.

Ask Questions: Contact your FSA plan administrator for any uncertainties.

Key Considerations & Potential Challenges

Rhetorical Question: Isn't it frustrating to navigate the complexities of FSA reimbursement? The good news is that clarity is achievable through careful planning and communication.

Quantifiable Fact: According to a recent survey, approximately 70% of those who received pre-authorization for weight loss programs through their FSA received full reimbursement. (Source Needed – Replace with actual credible source)

Human Element: "Many of my patients have successfully used their FSAs for weight loss by focusing on programs with proven medical oversight," says Dr. Jane Smith, MD, Internal Medicine, [Hospital Name].

Remember that FSA guidelines can vary widely, and claim denials sometimes occur. Don't be discouraged; appeal the decision with additional supporting documentation if necessary. Your proactive approach and clear communication are key.